Let’s clear the air: this is not 2008.

Foreclosures are still running below pre-pandemic levels, and most homeowners today hold solid equity. That’s reassuring. But if you look closer, there are signs of financial strain in the market—especially here in Florida.

This isn’t a crash warning. It’s a reminder that while the housing market remains strong overall, conditions are shifting, and it pays to stay informed.

📊 The Big Picture

Nationally, foreclosure activity is still relatively low compared to historic averages.

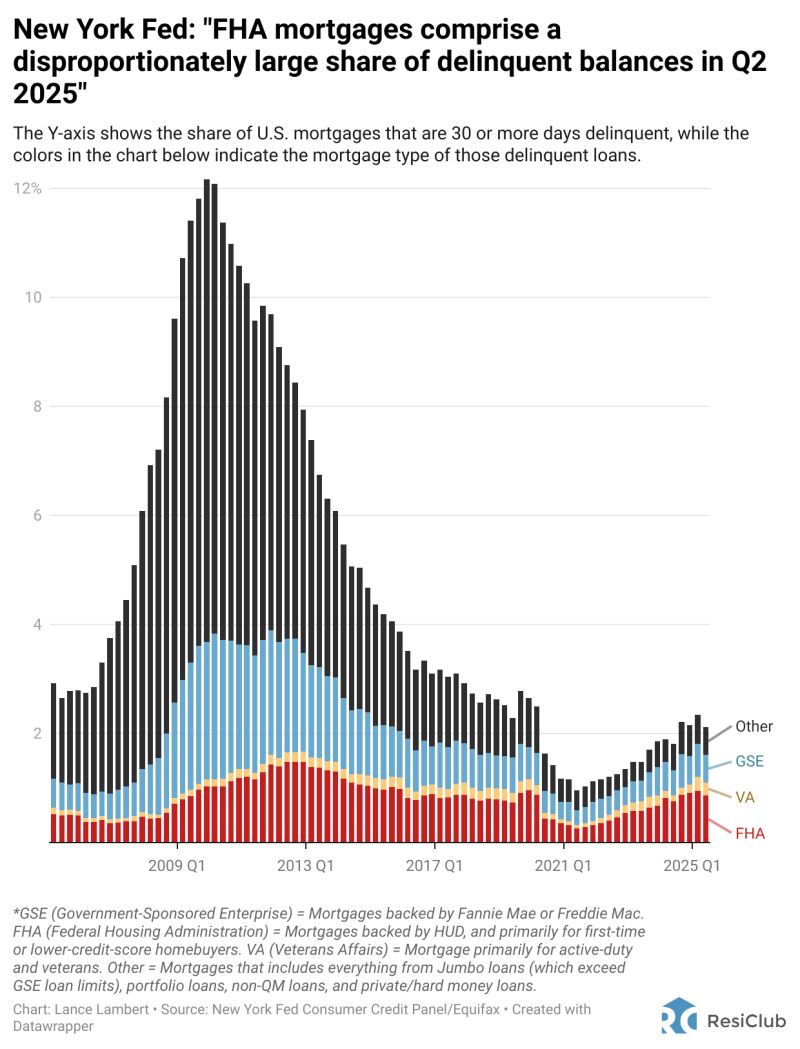

The area raising eyebrows? FHA loans.

FHA-backed mortgages—popular with first-time buyers and households with smaller down payments—have seen delinquencies rise from 3.7% in 2024 to 4.8% in early 2025, the highest level since 2017.

It’s not a wave of foreclosures, but it does show that some homeowners are feeling the squeeze.

💳 Why Households Are Feeling the Pressure

The uptick in FHA delinquencies fits into a larger pattern:

-

Credit defaults are ticking up – More families are falling behind on credit cards, auto loans, and other household debt.

-

The job market has softened slightly – Unemployment remains low, but hiring has slowed and certain industries are seeing layoffs.

-

Affordability has tightened – Between higher home prices, elevated interest rates, rising taxes, and insurance hikes, many budgets are stretched thinner than ever.

For buyers who stretched to get into the market a few years ago, those rising costs are starting to pinch.

🌴 Florida’s Twist

Here in Florida, affordability challenges are magnified.

-

Insurance premiums have surged by double digits in recent years.

-

Property taxes have climbed alongside home values.

-

Mortgage rates remain elevated compared to the ultra-low levels buyers locked in just a few years ago.

For many households, the math doesn’t stretch as easily as it used to. That doesn’t mean a foreclosure wave is coming—but it does highlight why careful planning is so important.

✅ Why This Still Isn’t 2008

It’s important to keep perspective.

-

Then (2008): Millions of homeowners were underwater with risky loans and little equity, leaving few options when the market turned.

-

Now (2025): Lending standards are stronger, most owners have meaningful equity, and many are sitting on fixed-rate mortgages well below today’s rates.

That equity cushion is a major buffer, and it’s why today’s situation looks very different from the crash of 2008.

🚦 What It Means for You

If you’re a buyer:

Market stress is creating opportunities you don’t want to miss.

-

Some sellers are more realistic on pricing, and others are offering concessions like closing cost credits or rate buy-downs.

-

Motivated sellers are even pricing below market value to move quickly—those properties are out there, they just need to be uncovered.

-

With the right strategy (and an agent who knows where to look), you can find homes that deliver long-term value.

If you’re a homeowner:

This is the time to get proactive about protecting your investment.

-

Review your property tax exemptions – Florida’s Homestead Exemption and others can reduce your bill if you’re eligible.

-

Ask about insurance discounts – From wind mitigation credits to security system discounts, many households leave money on the table.

-

Tap into my trusted vendor network – I work with excellent insurance agents, tax advisors, contractors, and home service providers who can help you maximize savings and maintain your home’s value.

Today’s buyers are smart and cautious, but with a customized launch strategy, you can position your home to sell quickly and for top value.

👉 Want to see what’s happening right in your neighborhood?

Reply to this blog (or reach out directly) and I’ll send you a localized foreclosure & delinquency snapshot for your zip code.

Bottom line: We’re not in a crisis. But affordability pressures, rising FHA delinquencies, and consumer strain are worth noting. Staying informed—and making smart adjustments—is the best way to stay ahead, whether you’re buying, selling, or simply keeping an eye on the market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link